The Current Bull and Bear Cases for Gold and Silver

It’s time for another rapid-fire breakdown of the bullish and bearish elements presently in play in the gold (GCQ25) and silver (SIN25) futures markets. Then I’ll give you my biases on price trajectories.

Bullish Factors for Gold and Silver

- Near-term and longer-term technicals remain firmly bullish, including price uptrends in place on the daily, weekly, and monthly bar charts.

- Safe-haven demand continues to flow into gold and silver amid still-elevated global trade tensions, Middle East uncertainty, and the ongoing Russia-Ukraine war.

- Central banks likely continue to accumulate gold as several major countries work to “de-dollarize” and hold other assets in their sovereign reserves. The BRICS (Brazil, Russia, India, China and South Africa) conference in early July will likely put a hotter spotlight on de-dollarization efforts among member countries.

- The U.S. Dollar Index ($DXY) (a basket of six major global currencies weighted against the greenback) is still not far above its yearly low and longer-term charts show prices still trending lower.

- Crude oil (CLN25) prices are trending up, and Nymex July crude this week hit a nine-week high.

- Geopolitical hotspots that are bullish for gold and silver are never far away from the front burner, including Middle East tensions and the Russia-Ukraine war.

Bearish Factors for Gold and Silver

- The bull-market run in gold that began in 2022 is very mature and bulls may now be tired. Gold prices have been trading sideways and choppy, on a daily basis, since the late-April record high.

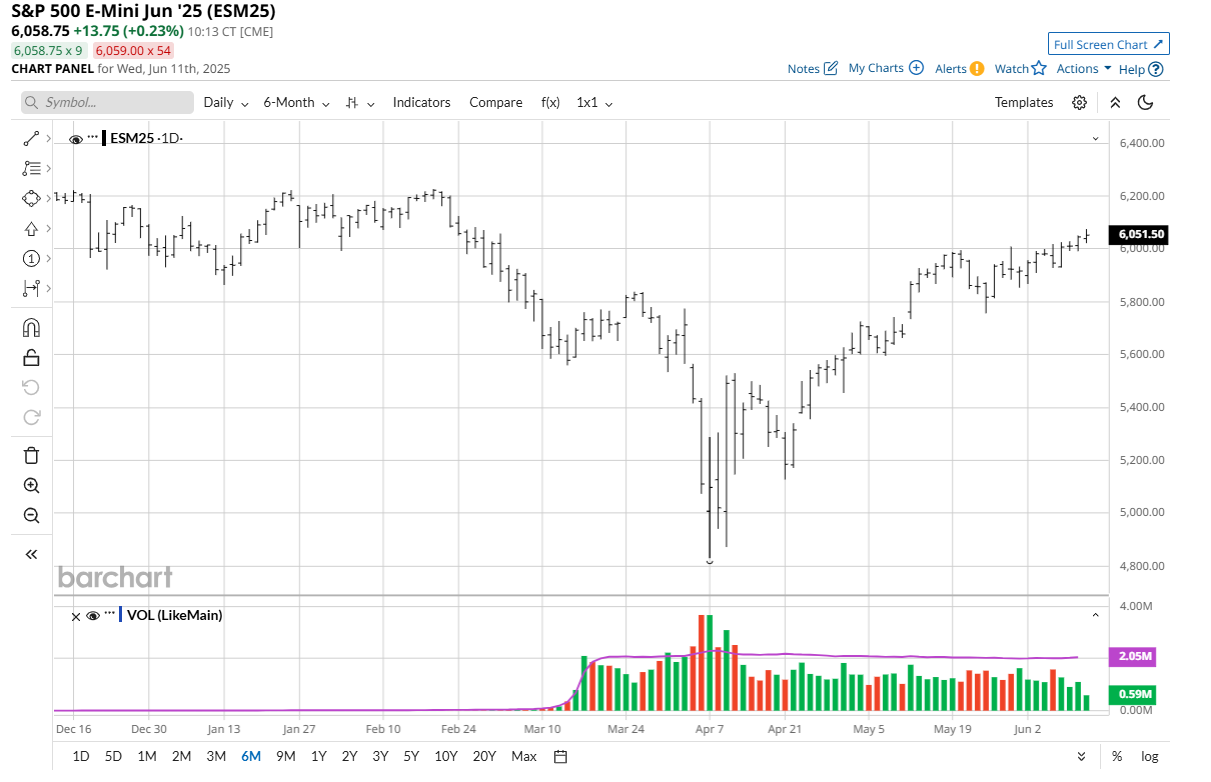

- The rallies in U.S. stock indexes to three-month highs this week suggest improved trader and investor risk appetite in the general marketplace, which is bearish for the safe-haven metals.

- Generally decent U.S economic numbers recently, along with the prospect of sticky price inflation, are likely to keep the Federal Reserve standing pat on its monetary policy and not lowering U.S. interest rates anytime soon. That’s bullish for the U.S. dollar and in turn bearish for gold and silver.

- Platinum’s (PLN25) strong price rally recently is likely prompting more speculative buying interest in platinum and taking away some investment demand for gold and silver.

It may be that global trade tensions have already peaked and that the situation will de-escalate in the coming weeks or months. That would be a bearish scenario for the safe-haven metals.

The 10-year U.S. Treasury note yield (V2Y00) that is presently around 4.5% is attractive to some investors and may be pulling away investor demand for gold and silver, which carry no dividends or annual yields.

My Bias on Gold and Silver Futures

I think gold prices will remain elevated but will need a fresh, major catalyst — likely via a geopolitical flare-up or major global incident — to push prices to a new record high in the coming months. The gold market has become more technically bullish recently, posting a strong rebound from the May low and restarting a price uptrend on the daily bar chart. However, the gold market has stiff technical resistance to overcome for prices to advance to new record highs. Those chart resistance levels are the May high of $3,477.30 and the contract high of $3,539.30, basis August Comex futures.

Since gold scored a new record high of $3,485.60 an ounce, basis nearby Comex futures, in April, I still maintain that silver appears to be a value-buying opportunity, since it’s still just under $15.00 below its record high.

I’ll bet I’ve forgotten something on the bull or bear side for gold and silver. Tell me what you think. I really enjoy getting email from my valued Barchart readers all over the world. Email me at jim@jimwyckoff.com.

On the date of publication, Jim Wyckoff did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.